Picture supply: Getty Photos

Passive investing has turn out to be the automobile of alternative for many buyers at present. It’s simple to see why. On the depths of the worldwide monetary disaster in early 2009, the S&P 500 sat at 750 factors. Since then, the index has gone on the most important bull market in its historical past and now trades at over 6,000. An increase of over 700% signifies that a £10,000 funding made then can be price £70,000 at present.

Environment friendly market speculation

Passive investing can hint its roots again to the Sixties in an instructional principle often called the environment friendly market speculation. The concept behind this principle is which are so many good, lively managers doing elementary and valuation evaluation that shares at all times commerce at their truthful market worth. This reality makes it tough for lively managers to persistently beat the market.

Initially confined to massive pension funds, passive investing methods started to go mainstream within the late Nineties. As we speak, index funds, and the newer innovation of exchange-traded funds (ETFs), are marketed as a low-cost, diversified strategy to investing.

S&P 500 bubble

Passive investing is a good technique when a inventory market is rising. However the inexorable rise of the US inventory market over the previous 15 years is, I imagine, breeding complacency.

One space that has involved me for a while is inventory market focus. If I spend money on an S&P 500 tracker, I’m supposedly shopping for right into a broad basket of shares throughout completely different sectors. However that isn’t the case anymore on condition that the highest 10 holdings are predominantly within the expertise house and account for 34% of all the weighting.

Simply because a passive investing technique has labored so effectively prior to now, doesn’t imply it is going to proceed to take action. And one full unknown at present is that these kinds of funding autos have by no means been examined in a real bear market. In spite of everything, the 2020 decline lasted only a handful of weeks and the decline in 2022 lasted solely 9 months.

I’m nonetheless choosing shares

A small proportion of my Shares and Shares ISA portfolio is allotted to an S&P 500 tracker. However for me now will not be the time to be asleep, which is why I predominantly decide my very own shares.

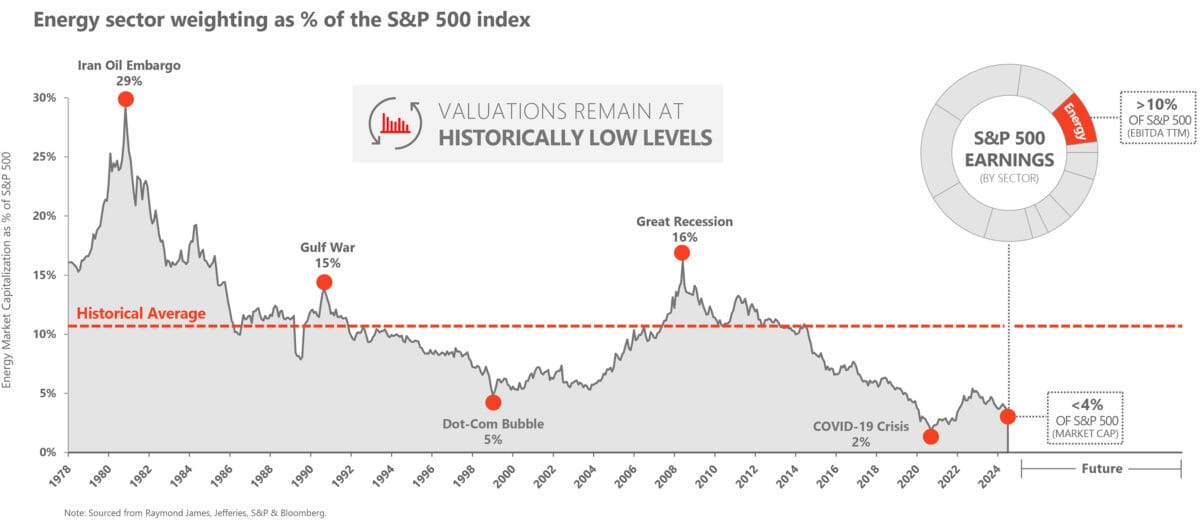

One sector that I stay bullish on in the long run is power. The next chart from Devon Power, highlights how distorted the market has turn out to be. The mixed weighting of the highest three shares, Apple, Nvidia, and Microsoft is 5 occasions all the power market. That to me screams alternative.

Supply: Devon Power

I’m of the view that we’re coming into a part the place demand for power goes to soar. Onshoring of producing functionality within the US continues at tempo. The acceleration of the inexperienced revolution will, sarcastically, drive a surge in demand for power, as the results of extremely energy-intensive mining operations for metals.

However the largest driver for power will come from the tech corporations themselves. Knowledge centre development to handle generative AI capabilities will see an explosion in power demand like we’ve by no means witnessed earlier than.

I notably like BP and Shell due to their ultra-cheap valuations in comparison with their US friends. Neither is priced to mirror what I see as an oncoming tsunami in demand over the subsequent decade and extra.